And start earning money 💸 by teaching English in your own country, abroad, or online from anywhere on the planet! 🎁 Gifts and bonuses: professional support from your personal coach 🧑🏫 and job placement assistant 💼.

Financial fluency. Mastering money talk, taxes, and essential English vocabulary

Table of contents

Money is a universal interest, yet discussing financial matters isn't second nature to everyone. As an EFL/ESL teacher, you have the unique opportunity to bridge this gap. Equip your students with the necessary English financial vocabulary and create a nurturing classroom environment where they can freely practice their communication skills without the fear of making mistakes.

Understanding finance is particularly crucial for those immigrating to an English-speaking country. It's not uncommon for newcomers to be baffled by terms like 'gross income' during job interviews. Moreover, the realization that their actual take-home pay is significantly less than the 'gross' figure due to taxes can be quite a revelation.

Start of the lesson

Kick off your lesson with a brainstorming session to gauge what your students already know about finance. Start the discussion with these questions:

- Does anyone know what 'gross income' is?

If no answers are forthcoming, provide the definition yourself. - Can anyone define 'net income'?

- What are the key differences between gross and net income?

- Do you pay taxes?

Offer additional explanation about 'taxes' if needed. - How much in taxes do you pay?

For example: Is it 5% of the gross income, or perhaps 30% of the net income? - Does the tax percentage vary depending on the income level?

- Are there tax brackets in your country?

Provide further explanation if required. - What are some common tax deductions people can claim to reduce their taxable income?

Learning English financial vocabulary

Once the students are engaged and have grasped the basic concept of the lesson, introduce them to the related vocabulary and examples. This methodical approach ensures that your students not only learn about finance in English but also feel confident in discussing it.

Budget: An estimate of income and expenditure for a set period.

Example: Creating a monthly budget helps in managing expenses.

Net Income: The amount of money left after all deductions are made.

Example: Her net income was lower due to increased tax rates.

Gross Income: Total income earned before any deductions.

Example: His gross income includes his salary and freelance earnings.

Tax Return: The form used to report income and taxes owed to the government.

Example: I filed my tax return before the April deadline.

Revenue: Income generated from business activities.

Example: The company's revenue increased after launching the new product.

Savings: Money that is saved, typically in a bank.

Example: I put 20% of my paycheck into savings every month.

Investment: Allocating money with the expectation of generating income or Prot.

Example: She made a significant investment in stocks.

Debt: Money owed to another party.

Example: He took on debt to finance his education.

Interest: The cost of borrowing money or the earnings from lending money.

Example: The interest rate on my savings account is 2%.

Loan: Money borrowed that is expected to be paid back with interest.

Example: They took out a loan to buy a house.

Mortgage: A loan taken out to buy property or land.

Example: Their mortgage payments are due monthly.

Credit Score: A numerical expression based on credit history, indicating the creditworthiness of an individual.

Example: A high credit score allowed her to get favorable loan terms.

Asset: Anything of value or a resource of value that can be converted into cash.

Example: Real estate properties are considered valuable assets.

Liability: A financial obligation or debt.

Example: Unpaid loans are counted as liabilities.

Expense: The cost required for something or the money spent on something.

Example: Monthly utilities are a regular expense.

Bankruptcy: A legal status of a person or entity that cannot repay debts to creditors.

Example: The company declared bankruptcy after failing to repay its debts.

Equity: The value of shares issued by a company.

Example: He owns 15% equity in the startup.

Inflation: The rate at which the general level of prices for goods and services is increasing over time, leading to a decrease in purchasing power.

Example: Inflation caused the cost of groceries to increase.

Dividend: A sum of money paid regularly by a company to its shareholders out of its Prots.

Example: She received quarterly dividends from her stock investments.

Capital Gains: The Prot earned from the sale of an asset that has increased in value.

Example: He made substantial capital gains from selling his real estate property.

To Be in the Red: To have a negative balance or owe money, often in a bank account or business operation.

Example: After several poor financial decisions, the company found itself in the red.

To Be in the Black: To be Protable or financially solvent, not owing any money.

Example: Thanks to increased sales, the business is now in the black.

Reading financial literature in English

Begin a dialogue with your students about their engagement with financial literature. Inquire about the frequency with which they read economic magazines and financial articles. Probe into the importance of finance in their lives and explore their thoughts on the necessity of financial literacy.

Incorporating a Reading Comprehension task into this lesson could be highly beneficial. It's common for English learners to feel intimidated by articles dense with financial or technical terminology. As a teacher, your aim is to cultivate confidence in your students, guiding them towards becoming Procient English speakers. Introducing them to financial articles is a strategic step towards achieving this goal.

Encourage your students to read the article out loud, one by one, fostering an inclusive and collaborative learning environment. Advise them to mark any words or phrases they don't understand. This practice not only enhances their vocabulary but also gradually familiarizes them with the language of finance, making it more accessible and less daunting. Your support in this journey is crucial in helping your students navigate the complexities of financial terminology with confidence.

Use for example this text:

The landscape of world finances is a complex and dynamic arena that reflects the interconnectedness of global economies. In recent years, several key factors have significantly influenced the world's financial systems, including technological advancements, geopolitical shifts, and environmental concerns.

One of the defining features of modern finance is globalization. The interconnectivity of markets means that financial decisions and events in one part of the world can have immediate and far-reaching impacts globally. This interconnectedness was evident during the 2008 financial crisis, which, originating in the U.S. housing market, quickly cascaded into a global economic downturn.

Technology, particularly the rise of digital finance and cryptocurrencies, is reshaping how we think about money and transactions. Digital currencies like Bitcoin and Ethereum offer new ways of processing payments, bypassing traditional banking systems. However, they also present challenges in terms of regulation and stability.

Environmental, social, and governance (ESG) issues are increasingly at the forefront of financial considerations. There's a growing trend among investors to factor in a company's impact on the environment, its social responsibility, and governance structures before investing. This shift reflects a broader understanding that long-term financial success is tied to sustainable practices.

Emerging markets are playing a more significant role in the global financial landscape. Countries like China, India, and Brazil have become major players, influencing global trade and investment patterns. Their growth presents opportunities but also risks, given their different regulatory environments and economic volatility.

Interest rates set by central banks are a crucial lever in the world of finance. They influence borrowing costs for individuals and businesses, impacting everything from mortgage rates to business investment decisions. The U.S. Federal Reserve, the European Central Bank, and other central banks play a pivotal role in shaping the global economic environment through their monetary policy decisions.

Public debt levels, particularly in developed countries, have risen sharply, partly due to increased government spending to combat the economic fallout of the COVID-19 pandemic. High levels of debt can limit governments' ability to respond to future crises and may pose long-term economic risks.

Trade tensions and protectionism also have significant implications for world finances. Tariffs, trade barriers, and geopolitical conflicts can disrupt global supply chains and impact economic growth. The U.S.-China trade war is a recent example of how such tensions can have wide-ranging effects on financial markets and the global economy.

Finally, the growing trend of deglobalization, or the retreat from global economic integration, poses new challenges. Countries focusing more on national interests and less on global cooperation could lead to a fragmented global market, impacting everything from currency stability to international investments.

In conclusion, the world of finance is a barometer of global economic health and sentiment. It is influenced by a myriad of factors, from the micro-level decisions of individual investors to the macro-level policies of governments and central banks. Understanding these dynamics is crucial for anyone involved in the financial sector, from policymakers to investors, as they navigate the ever-changing landscape of global finance. As the world continues to grapple with economic uncertainties and transitions, the agility and adaptability of financial systems and markets remain key to sustaining global economic stability and growth.

💡 Unlock the secrets to doubling your teaching income with our exclusive checklist! 🎯 This checklist is designed for English teachers who want to 📈 attract more students and 🔥 keep them engaged for the long term.

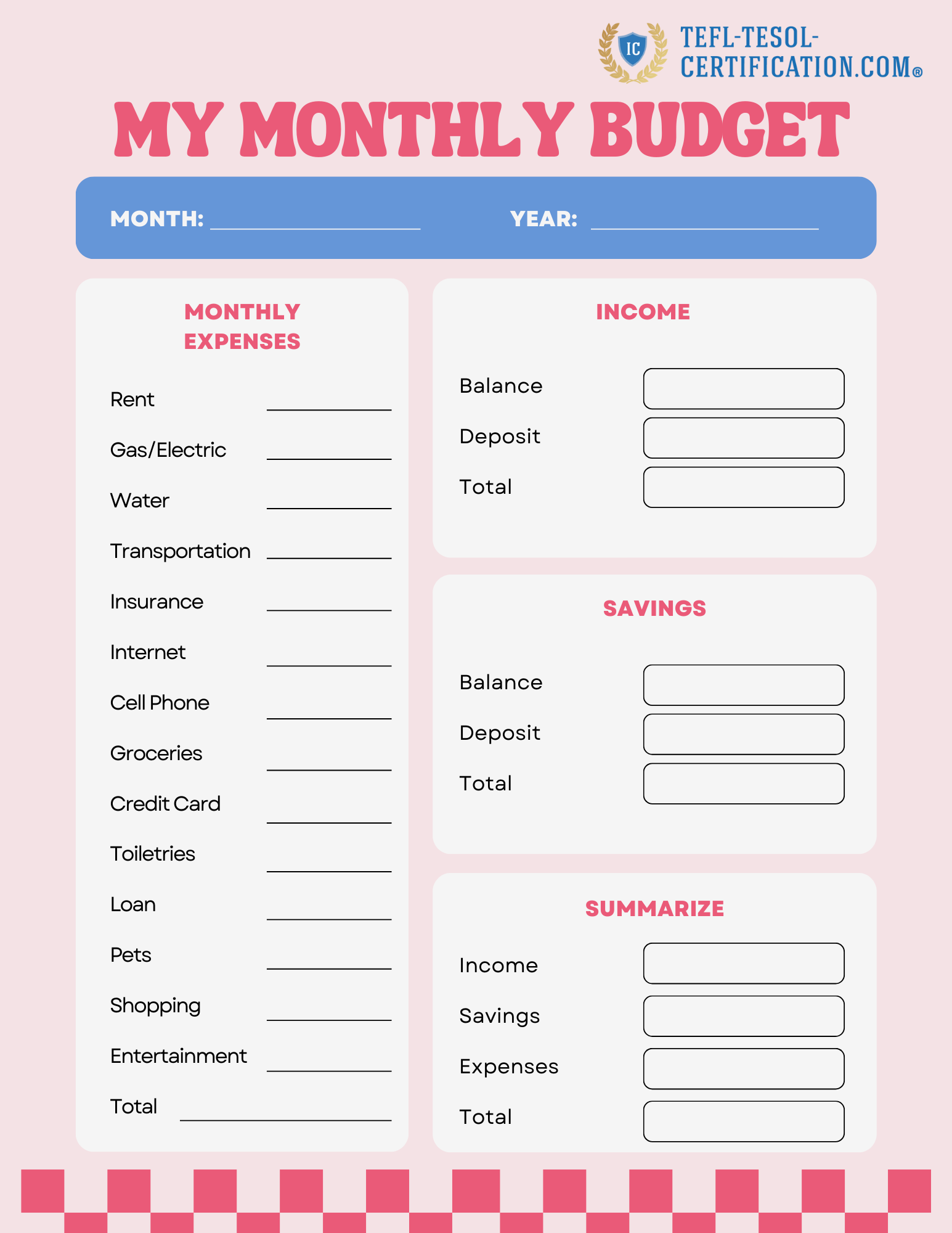

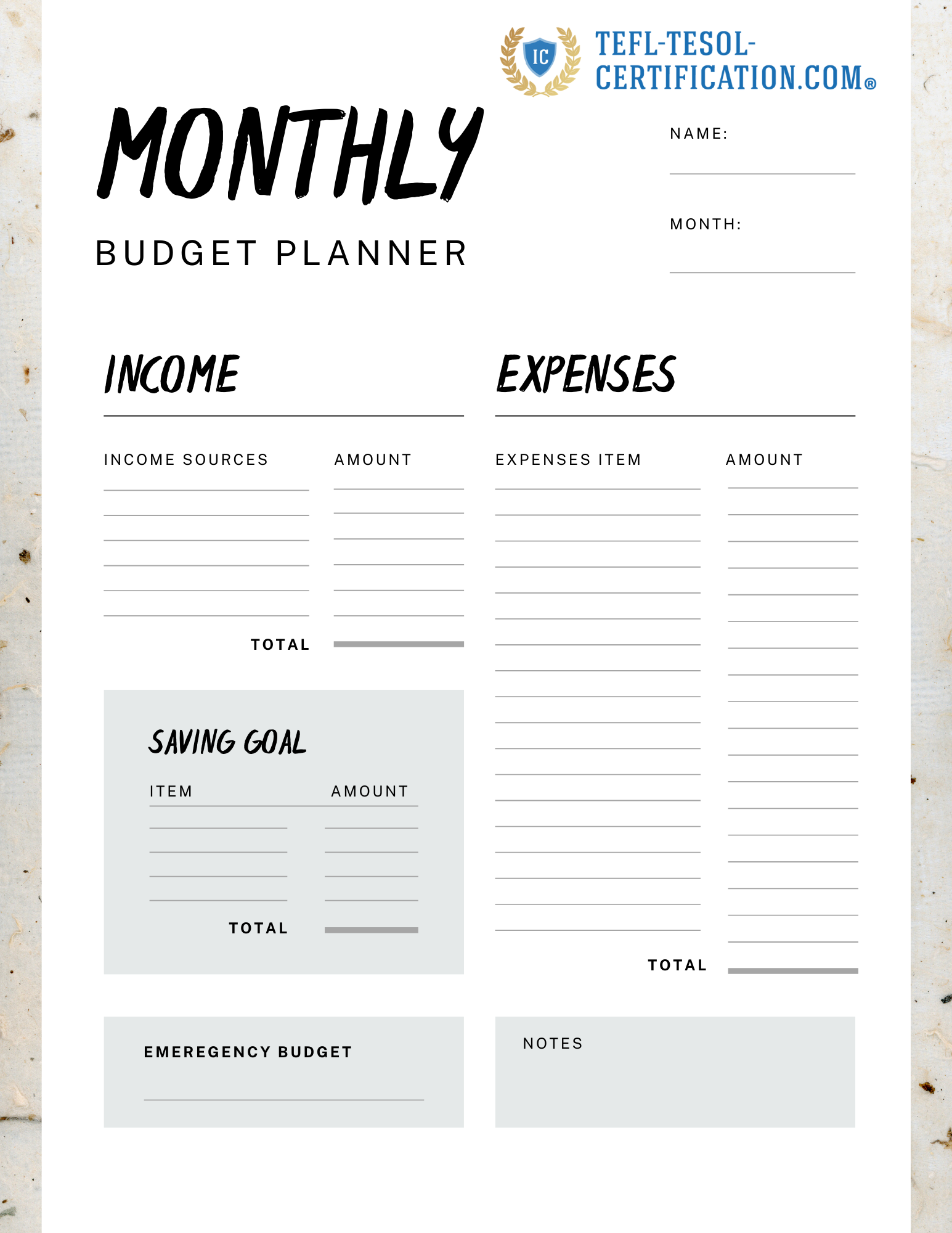

The budget planning task

After discussing the content of the article and ensuring all doubts are cleared, move on to the next activity, "Budget Planning." This task can be completed in groups, providing an opportunity for collaborative learning. Each group's objective is to create a straightforward budget, applying the finance-related vocabulary introduced in the lesson.

Encourage the students to engage in discussions within their groups, deciding on various budget components such as income, expenses, and savings. Emphasize the use of the newly learned financial terms, ensuring that their budget reflects a clear understanding of these concepts. This activity not only reinforces their vocabulary but also enhances their practical application of the language in real-life financial planning scenarios.

An Example of the Monthly Budget for John Doe

- Gross Income: $4,000 (Total monthly earnings before deductions)

- Net Income: $3,200 (Income after taxes and other deductions)

- Expenditures:

- Rent: $1,200

- Utilities (electricity, water, internet): $300

- Groceries: US$600

- Transportation (gas, public transit): $200

- Insurance (health, car): $300

- Debt Payments (credit card, loan): $300

- Miscellaneous (entertainment, dining out): $200

Total Expenditures: $2,900

- Savings:

- Emergency Fund: $100

- Investment Account: $200

Total Savings: $300

Summary:

- Total Income (Net): $3,200

- Total Expenditures: $2,900

- Total Savings: $300

- Balance (Net Income - Expenditures - Savings): $0

Or you can provide students with some forms to fill in.

The financial role-play activity in English class

In each lesson, it's essential to maximize opportunities for students to practice their communication skills. To facilitate this, pair students and involve them in a role-play scenario where one plays the role of a financial advisor and the other assumes the role of a client seeking guidance on budgeting and understanding taxes. Motivate them to incorporate the new vocabulary discussed during the lesson and to refer to the budget plan they have crafted.

Below is an example dialogue to serve as a guide for the role-play activity:

- Client: Hi, I'm feeling overwhelmed with managing my finances. Can you help me understand how to budget properly and handle my taxes?

- Financial Advisor: Of course! Let's start with your budget. What's your monthly income after taxes?

- Client: My net income is about $3,000 per month.

- Financial Advisor: Great, let's list your monthly expenditures like rent, utilities, and groceries. Do you have these figures?

- Client: Yes, my rent is $1,200, utilities are around $300, and I spend about US$600 on groceries.

- Financial Advisor: Perfect. Now, let’s consider other expenses like transportation, insurance, and any debt repayments.

- Client: Well, transportation costs me about $150, and insurance is $250. I'm also paying off a student loan, which is $200 monthly.

- Financial Advisor: Alright, that brings your total expenditures to $2,300. It's also important to save. How much do you usually save each month?

- Client: I try to put aside $200 for savings.

- Financial Advisor: That's good. With $200 in savings, your total outflow is $2,500. Now, regarding taxes, are you aware of potential deductions like education expenses or charitable donations?

- Client: Not really, can you explain that?

- Financial Advisor: Sure, certain expenses like educational fees or donations can be deducted from your taxable income, reducing your tax liability. It's important to keep records of these for your tax return.

- Client: I see. That could be useful for me.

- Financial Advisor: Absolutely. And remember, staying informed about tax laws and updates can really benefit your financial planning.

- Client: Thanks! I feel more confident about managing my finances and taxes now.

🚀 More students, 💰 higher income, 🌍 complete freedom! ✅ 112 verified platforms with top rates ⏳ Flexible schedule – work whenever and as much as you want 🎯 Simple requirements – start earning right away 💎 Boost your career and income by teaching students worldwide!

End of the lesson

For the lesson's evaluation, invite each student to share one new insight they gained about finances and taxes. This encourages reflection and reinforces learning.

For homework, ask students to write a concise essay or paragraph highlighting the significance of financial planning and tax understanding in daily life. Encourage them to apply the financial vocabulary introduced during the lesson, promoting the practical use of their new language skills.

Terms used:

EFL, ESL

York Fern

An English instructor with 12+ years of experience. I work for an online school and travel the world, teaching students from various countries, leveraging my TEFL/TESOL certification. Seeing the world's oceans, mountains, and cities with my own eyes has given me a profound appreciation for the importance of quality education and international communication.

and start earning by teaching English in your country, abroad, or online from anywhere in the world! Order the course with a 50% discount 💸 and receive as a gift the support of a personal coach 👨🏫 and job placement assistant! 🎁🚀 Hurry, limited spots available! 🏃♂️💨

💡 Unlock the secrets to doubling your teaching income with our exclusive checklist! 🎯 This checklist is designed for English teachers who want to 📈 attract more students and 🔥 keep them engaged for the long term.

🚀 More students, 💰 higher income, 🌍 complete freedom! ✅ 112 verified platforms with top rates ⏳ Flexible schedule – work whenever and as much as you want 🎯 Simple requirements – start earning right away 💎 Boost your career and income by teaching students worldwide!

choose us?